Interview: Do efforts to combat money laundering really work?

Interview (13:02) - for key breakpoints see below, "This Interview"

Materials

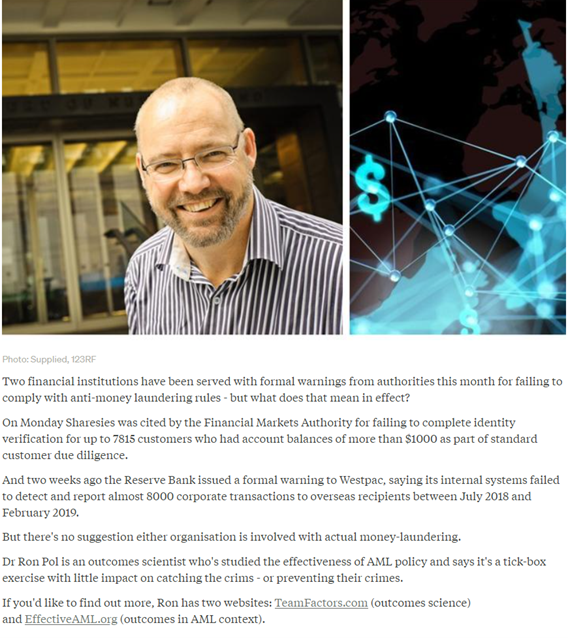

FMA warning to Sharesies: Media Release, Warning (PDF)

RBNZ warning to Westpac: Media release, Warning

This interview

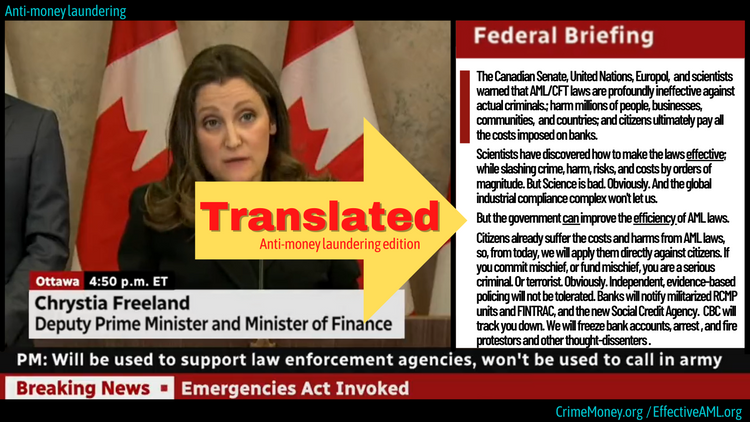

The latest evidence-based findings reveal that top-down change is no longer the only option. It is now possible for individual countries or banks to slash crime and regulatory risk respectively, and potentially act as a leadership catalyst to flip decades of failure, for success as G7 leaders intended. Although many key strands have long been identified by scientists, innovative leadership opportunities remain largely invisible to the dominant orthodoxy. A tipping point may be approaching, but the official narrative remains locked in denial, "how we've always done things", and failure baked into the design. In the meantime, this interview outlines a few of the issues identified by scientists over the past three decades.

0:50 Policy effectiveness/outcomes science, vanishingly rare in AML.

1:43 From 1980s, NPM target-setting took hold in government thinking. AML was set up at height of NPM, focuses on compliance not outcomes, measures what the system does, not what it achieves.

3:35 Are firms doing what they're supposed to? Yes, and that's the rub. The system is doing what it’s designed to do. That’s the problem. Penalize banks for breaching laws assumed to have impact on crime, whether or not any such impact, despite not designed for such impact, and evidence don’t have that impact.

5:00 Compliance to identify red flags/potential risk, even if no prosecutions, a good thing? Can be, but “a” risk claimed by regulators often theoretical. Sharesies and Westpac cases may be highwater mark. Regulators have data, not disclosed; good chance in both that zero actual incidence/risk of ML or crime.

7:50 Huge market for AML, market for effective AML does not yet exist. That's where there’s still a huge gap in the thinking. (And why practical, meaningful solutions remain hidden in plain sight, swamped by constant stream of in-group narrative affirming heavily touted silver bullet “solutions”, none of which, nor all combined, has had (nor can have) any material impact, as the juggernaut rolls on).

8:28 If we are seen as a soft touch, might there be more crime? That’s the rhetoric and belief, but science is interested in evidence. AML laws are based on a series of assumptions of impact on crime (including law making based on assumptions, ignoring evidence), but when scientists, even UN, Europol, test those assumptions and search for underlying facts, it reveals something else entirely.

10:50 It sounds like outcomes science would be valuable across government more broadly, and truly knowing the effectiveness of policies. Agreed. Post NPM, some agencies “get” modern outcomes science. But NPM still heavily ingrained in public sector, and “outcomes” a common word. Everyone “knows” what it means, so no perceived need to engage with hard science, and intended outcomes in many areas persistently not achieved as new policies claiming “outcomes” not connected with the science lock in another decade of poor outcomes; health, education, etc.

More...

Why anti-money laundering is like Gallipoli. AML battle plan draws from history but misses the one thing WWI generals got right.

Effective AML, oxymoron. A casual example of an uncomfortable alliance, unconsummated even as it enters a fourth decade. And a slightly tongue-in-cheek romp through the history of AML effectiveness.

The biggest problem with AML. The market for AML is huge – yet crime, harm, risk, and costs escalate while the market for effective AML does not yet exist. However, profound failure signals opportunity for profound value, and opportunity to flip those metrics.