The biggest problem with AML

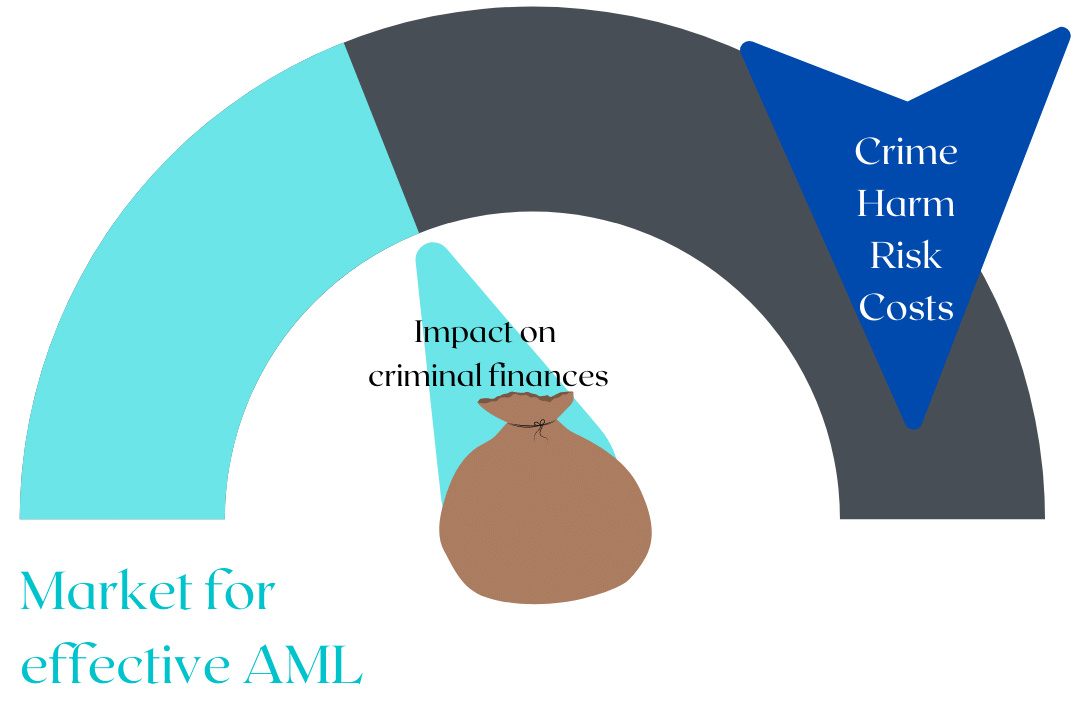

The market for AML is huge – yet crime, harm, risk, and costs continue to escalate while the market for effective AML does not yet exist. However, profound failure also signals opportunity for profound value, and to flip those metrics.

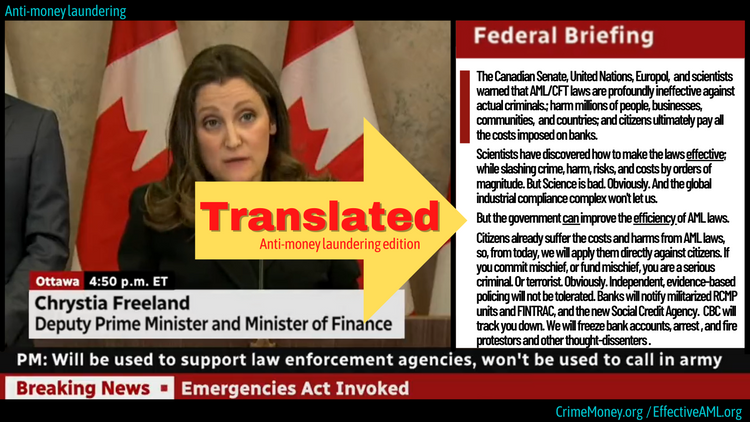

The likely impact of heavily touted “solutions” and “radical” reforms is bleak while talk about “effectiveness” remains disconnected from proven public policy principles and outcomes methodologies. Likewise, while the global industrial compliance complex overlooks uncomfortable realities. For example, AML was never designed to be effective, nor to achieve G7 goals, has repeatedly shunned effectiveness science, and is marked by profound failure.

Rather than face up to those fundamental issues, the global standard-setter, the Paris-based Financial Action Task Force (FATF), recently proclaimed that “isn’t where we should be focusing”. Instead, “everyone [just needs to] implement the standards we already have”. The policy prescription is simple. More of the same. Better and faster.

This means that AML systems and software will continue not to find most crime, and compliance costs and regulatory risk – bizarrely, based on breaking rules with no proven substantial impact on crime, functionally impossible to comply with, and irrespective any evidence of laundering or crime – will keep escalating.

That is a direct function of system design, like a giant stack of colanders to catch water, illustrated in the cartoon below. Unfortunately, it means today’s heavily touted “solutions” – framed in the same thinking, and repeatedly ignoring policy effectiveness and outcomes science – will likely have the same impact as scores of other claimed silver bullets over the past 30 years. Each touted “solution” – and all combined – continually “sweat” less than 0.1% impact on criminal finances.

[As noted previously, here and in peer-reviewed journals (one example, here), the UN “success rate” is not strictly an outcome metric and thus an imperfect crime prevention measure (and why this diagram distinguishes it from the social and economic harms from crime as arguably the ultimate metric). It is, however, a much closer proxy indicator towards anti-crime outcomes than the simplistic measures of “effort” and “activity”, mislabeled “outcomes” in AML orthodoxy, as outlined here and, in detail, here)].

In any event, in the absence of global leadership to seriously move the effectiveness dial, a small group of researchers began isolating practical, risk-free pathways for visionary country, law enforcement and bank leaders to markedly improve their own outcomes, risk-free (without affecting “the FATF tick” or regulatory relations). Even if top-down change is off the table, another decade of failure might still be avoidable.

In practical terms, for banks, the new approach removes any need to remonstrate with regulators, or quibble about the scope of absurdly complex regulations. Transformational impact, with new tools and strategies beyond compliance, allows banks for the first time to offer regulators what they demand and what they say they want – with the difference, and impact, for the first time robustly and objectively measurable. When regulators freely choose better outcomes, the bank’s regulatory risk plummets, and compliance costs follow.

Likewise, for countries. With measurable impact others might follow not because they must, but because it meets anti-crime policy objectives and slashes harm and costs imposed on legitimate businesses and ordinary citizens.

Eventually, if visionary leaders start to flip from followership to leadership, benefiting their customers and citizens with substantially less crime, harm, less regulatory risk, and costs, FATF might once again reclaim leadership towards achieving intended G7 objectives.

Chatting with this site’s first paid member [thank you! every contribution is critical for this conversation to continue], we agreed that the anti-money laundering movement no longer needs to be a negative sum game. It all started when she asked about the single biggest problem continually preventing the modern AML experiment achieving its laudable goals. Here is how the conversation went...