An effectiveness rating for FATF’s AML Effectiveness Report

FATF’s peculiar effectiveness narrative inadvertently extends the systemic failure of the global anti-money laundering system into a fourth decade.

As part of a Strategic Review by the Financial Action Task Force as global anti-money laundering standard-setter, FATF recently released a self-described “landmark report” with a “comprehensive overview” of anti-money laundering compliance and effectiveness.

The new report is a decade-long culmination of the “fourth round” of country-level evaluations which for three decades has repeatedly cycled through hundreds of jurisdictions in a costly and intrusive quest to assess the effectiveness of national anti-money laundering regimes.

Effectiveness matters

For context, FATF is a tiny unelected Paris-based supranational agency which sets and monitors compliance with anti-money laundering standards that 206 countries and jurisdictions “voluntarily” translate into national laws.

In reality, FATF standards are imposed on supposedly sovereign nations in a form of “voluntary coercion” ironically echoing a famous “offer they can’t refuse” strategy from The Godfather.

If countries don’t follow FATF standards, access to international financial markets is severely restricted, or cut off. Think North Korea. The FATF regime also imposes huge costs on businesses and citizens in countries that suffer poor ratings.

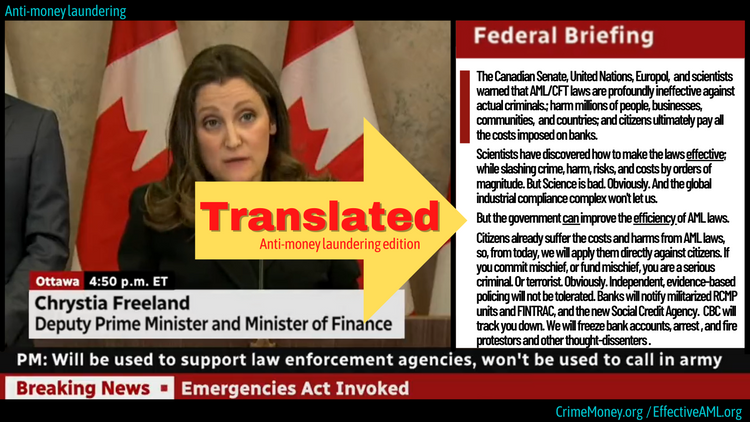

This means that FATF standards affect millions of businesses and people, whether the standards work, or not.

Moreover, national laws based on FATF standards have created a global mass financial surveillance regime. Banks, exchanges, and millions of other businesses must gather customers’ personal data, monitor their transactions, and report millions of financial transactions to authorities every week.

This means that anti-money laundering laws affect millions of businesses and people, whether the laws work, or not.

Clearly, the success or effectiveness of AML laws and standards matters. A lot. If the anti-money laundering system works, the immense costs and harms imposed on millions of citizens, communities, businesses, and countries might be justifiable. Or not.

So, how does FATF’s “effectiveness” report rate in terms of effectiveness?