The Paradox Papers

The latest round of coordinated outrage from a carefully manicured document leak – dubbed the Pandora Papers – provoked the usual storm of readymade “solutions” this week to “fix” the anti-money laundering system. But when perceptions (no doubt genuine) of “speaking truth to power” journalism unwittingly parrots a dominant narrative, and superficial questioning misses the wood for the trees, change is constant, while nothing really changes.

With the latest lesson in financial chicanery brought to us by the letter T, the current batch of leaked documents seem mostly related to trusts, transparency, and tax evasion.

There is no doubt that serious crime is a grave menace, but much is revealed by a media narrative that bundles criminal activity, decadence, and moralizing outrage, funneled into pre-packaged “fixes” that have had no material impact, nor can have any such impact, on those genuine dangers.

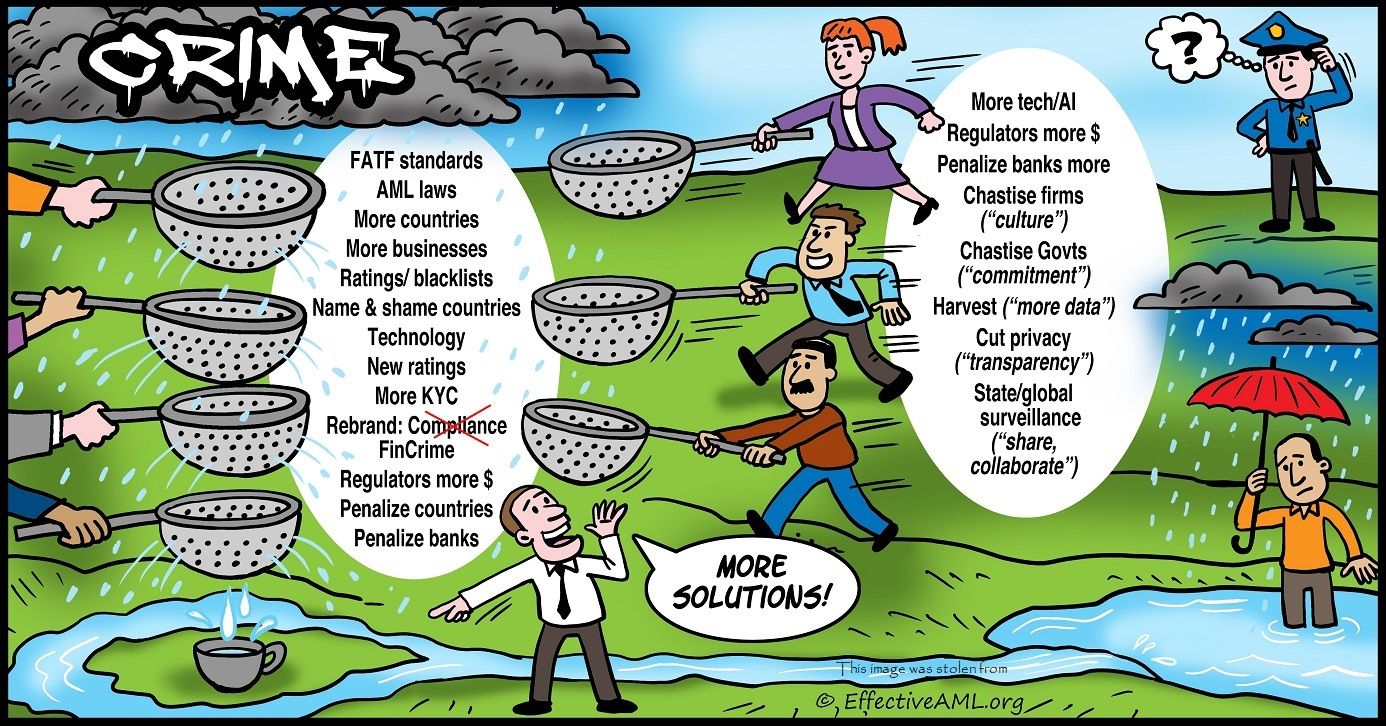

Nonetheless, oft-peddled “solutions” sound plausible, and well-meaning journalists, NGOs, and prominent commentators thunderously demand change and wheel out the same experts parroting the “right” narrative.

More regulations, more compliance, and infinitely more cost will fix the problem, this time, apparently.

Or not, as it happens. Reflexively promoting the ritualized narrative of a vast global compliance industrial complex disassociated from outcomes science has scarcely scratched the surface of crime, or terrorist financing.

Instead, readers’ sense of outrage is profitably provoked, symbolic scalps taken as trophies, journalism awards claimed, and regulations extended, all “proving” success.

After all, politicians – discomfited by expertly manufactured public outrage, advised by bureaucrats steeped in the dominant orthodoxy, and too busy for deep critical thinking – repeatedly deliver the laws demanded.

Don’t get me wrong. Journalists perform a vital public service and rightly expose such things. And, eventually, when they start asking hard questions about the anti-money laundering system itself, journalists may truly become leading catalysts enabling societal-level impact. (Likewise, officials steeped in the “in-group” socialized narrative, when they begin to incorporate complementary “outside” thinking like outcomes science).

Nonetheless, in the meantime, each new data leak is generally ‘good’ in at least a small-g sense in exposing criminal activity and hypocrisy. Prosecutions are justified. Changes are warranted, and some laws should indeed be fixed to help punish crime, catch more criminals, thwart more violent extremism, and expose corrupt and duplicitous elites.

Moreover, for many individuals and communities – like trafficking victims freed and corrupted treasuries reimbursed – investigative journalism often proves profoundly Good, in a capital-G way.

But here’s the rub. Anecdotal success against some criminals is not necessarily success against crime. Nor do individual successes “add up” by simple linear accretion, eventually accumulating into overall success.

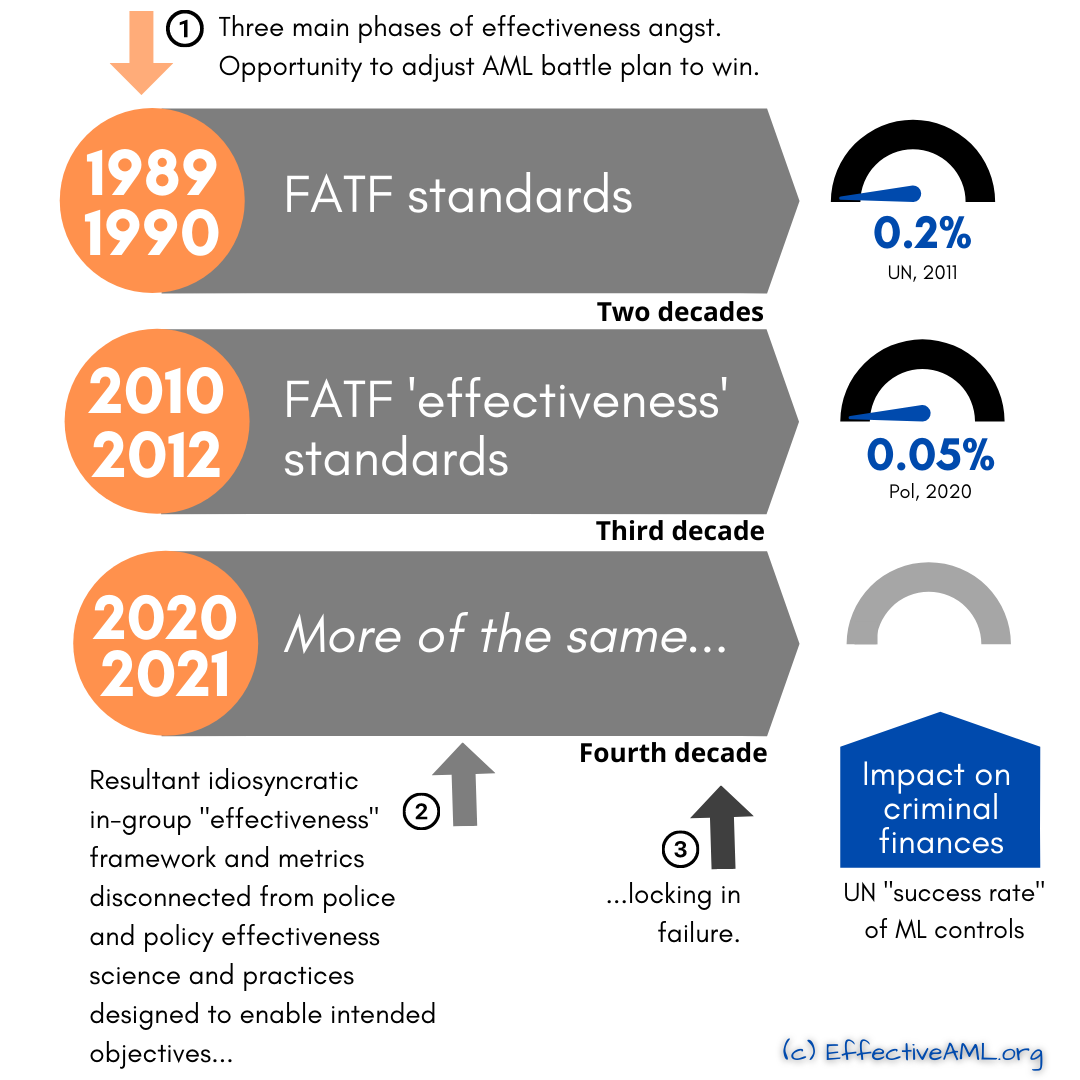

The United Nations’ “success rate” metric of money laundering controls offers a clue.

Despite trillions of dollars spent in the global “war” against money laundering – and three so-called “fundamental” reviews that studiously avoided reviewing anything fundamental – assiduously implementing hundreds of heavily touted silver-bullet “solutions” over three decades hardly signifies much progress while the impact of all that activity on criminal finances doggedly remained a fraction of a percentage point from zero.

Rather than successes accumulating, if the system is broken, incremental successes often prevent better outcomes.

Trouble is, none of the heavily touted “solutions” following each data leak, nor all of them combined – nor any of the silver bullet “solutions” claimed to “fix” the anti-money laundering system’s systemic effectiveness gap over the past three decades, nor all of them combined – has had any material, proven, demonstrable impact on money laundering, crime, or terrorism, nor can they, by design.

Curiously, despite seemingly fundamental failings, we are repeatedly told by anti-money laundering elite insiders that the system is sacrosanct, never to be questioned. Nor has it been, except by scientists, with pesky evidence published in peer-reviewed journals easily ignored while well-meaning intent, ingrained assumptions, and staunchly held beliefs remain untested, unquestioned, seemingly unquestionable.

Worse, the clamor for simplistic “quick fix” solutions obscures fundamental problems with the system itself, repeatedly prolonging systemic failure – like a perpetual motion machine constantly generating more standards, more regulations, more compliance, more cost, yet no material, demonstrable impact on money laundering, serious profit-motivated crime, or terrorism, forever.

Egregious abuse should continue to be exposed, but the anti-money laundering regime no longer needs to be a negative sum game or never-ending stream of exposés revealing shocking facts and undetected crime. It is time to step off the treadmill and examine its design. Early modelling reveals the prospect of a substantial, demonstrable impact on serious crime and terrorism, with less harm, less regulatory risk, and less compliance cost, not more.

Republished by LawFuel.com at The Paradox Papers – What Does The Pandora Papers Dump Really Mean For Anti-Money Laundering?